In a world where technology connects us more than ever, the shadow of scams creeps closer every day. They come dressed as too-good-to-be-true deals, urgent pleas, or heartfelt promises—designed to trick even the sharpest among us. It’s heartbreaking to see someone fall victim, to watch trust shattered and hard-earned money vanish in an instant. But here’s the truth: you don’t have to be a victim. By learning to recognize the red flags and spot the scams before they take hold, you can protect yourself and those you love from devastating loss. Let’s uncover the secrets scammers don’t want you to know, so you can stay one step ahead—because when it comes to your safety and peace of mind, being informed isn’t just smart, it’s essential.

Table of Contents

- Understanding Common Scam Tactics and How They Target You

- Recognizing the Warning Signs You Should Never Ignore

- Practical Steps to Protect Yourself and Secure Your Information

- What to Do if You Suspect You’re Being Scammed

- In Conclusion

Understanding Common Scam Tactics and How They Target You

Scammers don’t just rely on luck—they exploit deep psychological triggers to manipulate their victims. They prey on your emotions, creating a sense of urgency, fear, or excitement to force snap decisions. You might receive a heart-wrenching email from a “relative in distress,” or a perfectly crafted phishing website impersonating your bank. These tactics are designed to lower your defenses. Be aware that they often blend fact with fiction to sound credible, making it essential to pause, question, and verify before responding or sharing personal information.

Keep an eye out for these red flags, as they’re common threads in many scams:

- Unexpected requests for money or personal info—especially via unusual channels like cryptocurrency or gift cards.

- Poor grammar and spelling mistakes—a hallmark of many fraudulent messages.

- Too-good-to-be-true promises that guarantee big rewards with minimal effort.

- Pressure tactics urging you to act “right now” to avoid consequences.

- Lack of official contact details or inconsistencies in branding and communication.

Recognizing these warning signs empowers you to block fraudsters before they can hurt you. Stay vigilant; your skepticism is your best shield against emotional manipulation and deception.

Recognizing the Warning Signs You Should Never Ignore

In the world of scams, the most dangerous threats are often masked by a guise of urgency or charm. Pay close attention when messages or offers push you to act immediately—whether it’s a sudden investment opportunity, a “too-good-to-be-true” prize, or a plea for personal information. These pressure tactics are designed to cloud your judgment. Other red flags include vague or inconsistent details, unsolicited contact from unknown sources, and requests for payment via unconventional methods like gift cards or wire transfers. Trust your instincts; if something feels wrong, it probably is.

Keep an eye out for these warning signs in everyday interactions:

- Unsolicited offers that ask for upfront payment or sensitive data.

- Over-the-top compliments or emotional manipulation to gain your trust quickly.

- Requests for secrecy or discouragements from seeking advice elsewhere.

- Inconsistencies in communication, such as different contact details or misspelled official names.

- Suspicious links or attachments that push you to download files or surrender credentials.

When you recognize these warning signs, pause and verify before proceeding—sometimes, that short moment of skepticism can save you from a lifetime of regret.

Practical Steps to Protect Yourself and Secure Your Information

Stay vigilant and always verify before you trust. Scammers often rely on urgency and fear to cloud your judgment. Take a deep breath and pause—never rush into clicking links or sharing sensitive information. Use trusted sources and direct contacts to confirm offers or requests. Enable two-factor authentication wherever possible; it’s a powerful shield that adds an extra layer between your data and those who want to exploit it. Regularly update your passwords and avoid using the same password across multiple accounts to minimize risk.

Keep your devices and software updated to patch vulnerabilities that scammers can exploit. Educate yourself about the latest scams and typical red flags such as unexpected requests for money, promises of unrealistic rewards, or emotional manipulation. Consider these practical habits to protect yourself:

- Never provide personal information over unsolicited calls or emails.

- Use secure, encrypted connections (look for “https” in URLs).

- Install reputable anti-virus and anti-malware software and keep it current.

- Watch out for spelling mistakes and generic greetings—they often signal phishing attempts.

What to Do if You Suspect You’re Being Scammed

When the nagging feeling creeps in that something isn’t quite right, trust it. Your intuition is often the first line of defense against scams. One of the most crucial steps you can take is to pause and avoid rushing into any decision. Scammers thrive on urgency, pushing you to act before you have a chance to think or verify. Instead, take a deep breath, ask questions, and seek a second opinion. Reach out to a trusted friend, family member, or contact relevant authorities to discuss the situation. Remember, legitimate organizations will never pressure you or demand sensitive information out of the blue.

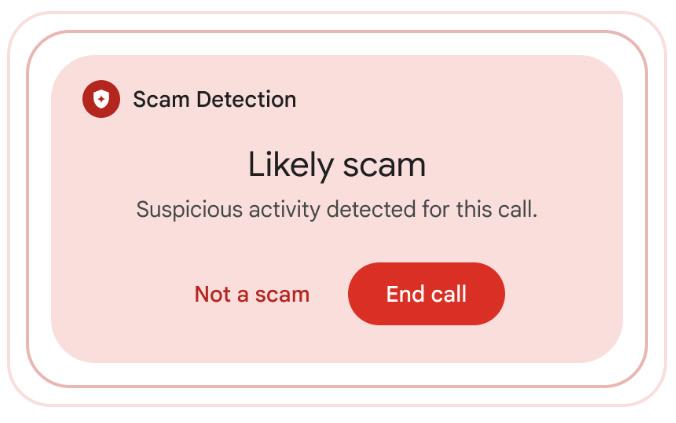

Next, protect yourself by documenting everything. Save emails, take screenshots, and keep any suspicious messages or calls recorded if possible. Having clear evidence can be invaluable when reporting fraud to consumer protection agencies or your bank. Here are some quick actions to guide you immediately:

- Do not share personal or financial details.

- Disconnect communication with the suspected scammer.

- Report the incident to official fraud reporting platforms.

- Check your bank statements and credit reports for unauthorized activity.

In Conclusion

At the end of the day, scams aren’t just about losing money—they’re about losing trust, feeling betrayed, and sometimes even doubting ourselves. But remember, knowledge is your greatest shield. By staying vigilant, recognizing those red flags, and trusting your instincts, you can protect yourself and your loved ones from falling into these traps. Don’t let scammers steal your peace of mind. Stay informed, stay cautious, and most importantly, stay strong. Because when you know what to look for, you’re already one step ahead—and that makes all the difference.